Trade numbers are an interesting thing. Though trade statistics are lagging indicators, they still reveal important trends. And while the numbers from the first half of 2023 for Miami tell a unique story, the headwinds and tailwinds of global trade for the entire U.S. are also important factors affecting our trade. So, let’s begin with a quick notation of the larger trends that also impact Miami:

• Mexico overtook China this year as the U.S.’ top trading partner • China exports fell at the steepest pace since 2020

• Inflation unevenly impacted consumer demand

• The U.S. trade deficit contracted 4.1% to $65.5 billion in June

With this as context, let’s look at Miami Customs Trade District data. U.S. Customs District 52 (Miami) is comprised of the following ports: Miami International Airport (MIA), Port of Key West, PortMiami, Port Everglades, Ft. Lauderdale International Airport, West Palm Beach International Airport, and Port of Palm Beach. The most significant movers of trade/cargo are MIA, PortMiami and Port Everglades. Customs trade data collection is not perfect and undercounts our trade with important trading partners such as Mexico and Canada, as our trade with these countries generally moves by truck and by train. This data also measures merchandise trade, which includes goods made elsewhere, but does not reveal Miami’s large surplus in the trade of services.

During the first half of the year, Miami’s trading scene for the most part showcased steady trade levels, with a few stand-out changes. Trade with China dipped by 6.7 percent, while Mexico enjoyed a boost of 4.24 percent, mirroring U.S. trends. A notable highlight was Miami’s maritime trade growth: containerized (ocean) trade grew over 9 percent, powered by a 24 percent rise in such imports from Mexico. This growth underscores the success of The Florida-Mexico Work Group on Maritime Commerce, co-established by the Florida Ports Council and Mexico’s Coordinación General de Puertos y Marina Mercante-DGCPMM (see story pg 36). I proudly stand as a co-founder, and the World Trade Center Miami fervently backs our mission, even spearheading a 2022 trade mission to Mexico.

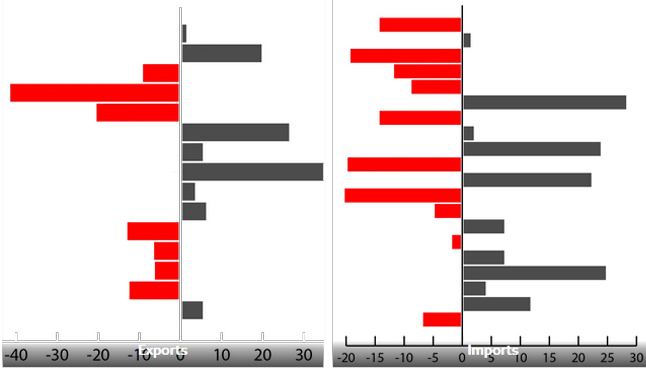

A quick snapshot of 2022-23 year-to-date numbers reveal the overall trade ebbs and flows. Total imports marginally grew, whereas exports shrank by 1.19 percent. Multiple factors influence these dynamics, including inflation’s drag on consumer goods demand. An example? Vietnam, previously riding high in the China trade tussle, saw a nearly 20 percent reduction in exports to Miami as consumer goods demand slumped. On the flip side, we witnessed impressive import spikes from:

• Costa Rica, up by 28%, fueled by a 98% increase in Electrical Equipment imports.

• Brazil, climbing 24.5%, owing to a 260% spike in Aviation imports.

• Germany, escalating almost 24%, thanks to a 57% increase in Machinery imports.

• The UK, surging around 22%, propelled by a remarkable Petroleum influx of over 1000%.

When it comes to exports, Paraguay led with a 37% annual growth. As the top U.S. state exporting to Paraguay, Florida’s growth was driven by surges in Pharmaceuticals, Watches, Office Machines, and Chemical Fertilizers. The latter’s rise could be linked to Paraguay outpacing Argentina in soybean production. Other growing export markets include:

• The Bahamas, rising nearly 26% on the back of a 155% increase of Yacht and boat growth.

• Mexico, up over 19% due to an over 160% Aviation Parts boom.

However, not all was rosy. Exports to the UK plunged, mainly from a 57 percent drop in Pharmaceuticals – a sector Miami had relied on for consistent growth. Exports also dropped to Honduras, Argentina, and Colombia, countries experiencing economic downturns and/or political unrest. All in all, Miami’s trading partners experienced quite a whirlwind. The upcoming months promise more twists and turns. Stay tuned!

Alice E. Ancona is COO and a senior vice president of the World Trade Center Miami. Data source (U.S. Census & International Trade Administration)