In a year that showed substantial trade growth, airports dominated

By Alice E. Ancona

The year 2022 was certainly the beginning of the “next normal” in many ways. Trade and supply chains were in disarray, economies were still recovering from the pandemic, and everything was further complicated by the start of the Russia-Ukraine war. With all of that, trade had its own ups and downs in South Florida. Let’s begin with trade shifts.

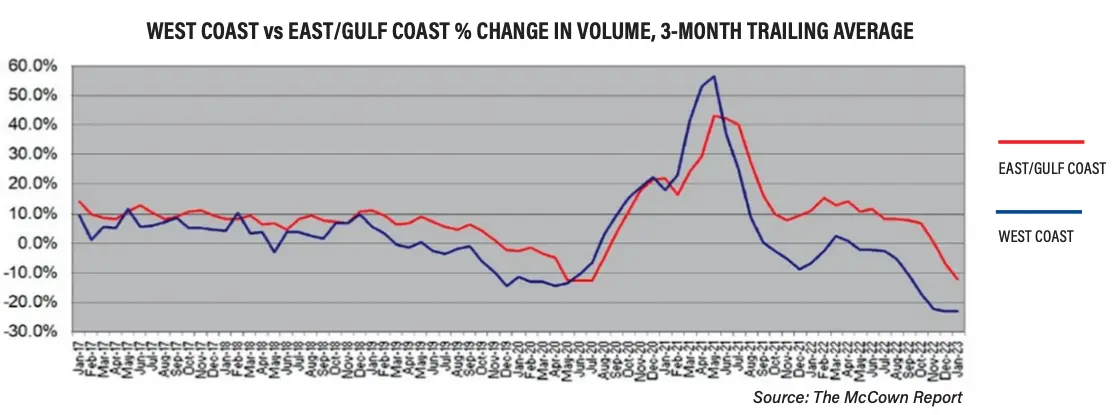

Towards the end of 2022, supply chains began to stabilize and transportation costs decreased – both contributing factors for inflation. Demand tapered off but the dollar remained strong. And something interesting happened at the end of the year: East Coast and Gulf Coast ports won the trade war.

Since the opening of the expanded Panama Canal in 2016, East Coast and Gulf Coast ports have been chipping away at the long-standing dominance of West Coast ports over cargo. Many factors, including West Coast supply chain disruptions, have worked in their favor, and by the end of 2022 their victory was achieved. While some importers may return to the West Coast, it’s estimated that approximately 10 percent of that cargo will not.

These changes in trade flows have created opportunities for Florida’s ports. However, here in Miami, we do trade a little differently. Over 80 percent of global trade moves by ocean, but in Miami and South Florida it mostly goes through airports. In fact, Florida’s No. 1 port for imports and exports by value is Miami International Airport (MIA), responsible for approximately 44 percent of Florida’s trade by value and approximately 50 percent of the state’s origin exports (products made in Florida).

Customs trade data collection is not perfect – it often undercounts our trade with important partners like Mexico and Canada since trade with these countries generally moves by truck or train and not through the air. It also measures merchandise trade, which is important to keep in mind as it is tied to how we trade.

In 2022, despite the strong dollar and high transportation costs, the district reported an increase in merchandise exports of 14 percent year-over-year for a total of $74 billion. For imports, the increase was 12.7 percent year-over-year for a total of $62 billion. Most importantly, Latin American and Caribbean trade remained strong and growing (for the most part).

Perhaps even more interesting is the movement of re-exports – unaltered, previously imported goods that are then exported from the U.S. In 2022, 29 percent of the Miami Customs District’s imports were re-exported, totaling $18.3 billion – a year-over-year growth of 14 percent. This represents approximately 24 percent of our exports.

Below are the top markets where our re-exports are going to. No surprise – they’re primarily located in Latin America and the Caribbean.

WHAT’S NEXT?

While it’s encouraging to see that trade grew in 2022, a slowdown is still expected in 2023. Trade and the supply chain underwent great stress during the peak of the pandemic, first slowing down and then surging with demand post-pandemic. There was much concern over what trade would look like in the “next normal.” For us in Miami/ South Florida, the “next normal” is tied to our dominance in sourcing and supplying (re-exporting) to the Latin American region and to the new opportunities that the cargo shift from West Coast ports to East Coast and Gulf Coast ports represents.

Deeper in the trade data for Miami and South Florida is India, currently ranked No. 21 for exports and No. 34 for imports. Year after year, our trade with India has increased slowly but steadily. As supply chains continue to shift out of China and into other parts of the region, India has become a big winner with companies like Apple, which is looking to boost iPhone production in the country by 25 percent by 2025.

Our “next normal” could see new and exciting expansions in trade with other parts of the world as we capitalize on the shift between ports and our growing re-export market